Why cross-border payments stall and how to fix it

Cross-border payments work well until they don’t. For the vast majority of transfers, the process is instant or takes just a few hours. But for roughly 1.8% to 4.5% of transactions, the process breaks down.

Sometimes, this is visible to the customer. They might see a 'failure' notification or receive an email asking for the purpose of payment. Other times, the issue is invisible, and the customer only realizes something is wrong when the funds don't arrive on time.

We interviewed payments operations and support teams at 15 banks and fintechs, ranging from large international institutions to smaller regional players and startups, to understand what happens in that margin of error. We spoke directly with the people handling these cases daily to understand the real friction. We wanted to know why exactly payments get stuck in 2026 , and why resolution takes so long, and why "Where is my money?" remains the hardest question for bank and fintech staff to answer.

The chain

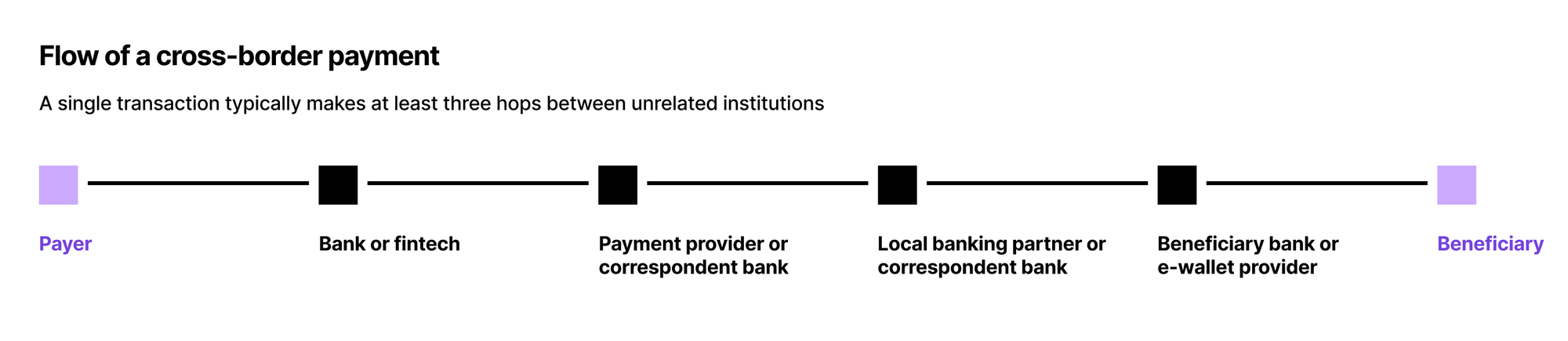

A cross-border payment has to pass through multiple hands. It starts with the originating bank or fintech, moves to a payment provider or correspondent bank, and makes at least one more hop to a local banking partner with access to the domestic clearing scheme (or another correspondent or two) before finally reaching the beneficiary’s bank account or e-wallet.

In theory, this shouldn’t be a problem. In practice, no single party has visibility into the full path (and, interestingly, local banking partners of payment providers may not even know which institution actually initiated the transfer). Each party only has a bilateral relationship with the next one in the chain, with no direct link to downstream intermediaries.

If an issue (for example, a compliance hold, missing liquidity in a nostro account, or a data mismatch) occurs deeper in the chain, the originator wouldn't even know it happened. 'Unstucking' it requires escalating to their immediate counterparty, triggering a slow chain of sequential, bilateral messages. Meanwhile, the payer is left waiting, and support teams can’t give a clear answer because they don’t have one.

The cost of exceptions

It is tempting to measure the cost of these errors simply by looking at investigator time. Our analysis suggests a typical manual investigation costs between $1 and $6 in direct labor.

But that number is misleading. The real cost is the strain on the customer relationship.

Support agents from both large and small institutions told us that customers struggle to accept that their money is simply 'somewhere in between'. 'Processing' is not a satisfying answer when a large sum is missing from the balance, and 'Failed' is not an acceptable outcome for an urgent payment.

In interviews, teams consistently pointed to these cases as the main drivers of escalations, churn risk, and negative reviews. A small percentage of failures creates a disproportionate amount of customer pain.

Moving to automated resolution

Our report, 'Where’s the Money?', breaks down the data behind payment exceptions. We analyze:

- The frequency of different exception types,

- The operational bottlenecks that turn minor errors into weeks-long delays,

- The maturity curve: how organizations move from reactive support tickets to automated, proactive exception handling.

How Paygent fits in

Paygent is PaySway’s engine for automatically resolving bank transfer issues. It runs inside tools like Jira, Linear, and Zendesk, where it pulls payment context, summarizes the issue, suggests the right product tickets, drafts bank responses, looks up the relevant contacts, and triggers the appropriate follow-up actions based on the exception type.

Paygent removes the need for operations teams to manually chase banks or decipher raw payment messages, freeing specialists to focus on cases that actually need human judgement. Platforms such as Deel and Apron already rely on PaySway to keep local and international payments running smoothly.

You can read the full findings in the report. To access the complete version, DM Dmitry Larkin on LinkedIn or email dmitry@paysway.io.